The recent appointment of Mrs Inonge Wina as the country’s first female Republican Vice President by President Edgar Lungu has this week reminded me of the role her late husband Arthur Wina played as Zambia’s first Minister of Finance when the country gained its Independence from Britain in October 1964.

The recent appointment of Mrs Inonge Wina as the country’s first female Republican Vice President by President Edgar Lungu has this week reminded me of the role her late husband Arthur Wina played as Zambia’s first Minister of Finance when the country gained its Independence from Britain in October 1964.

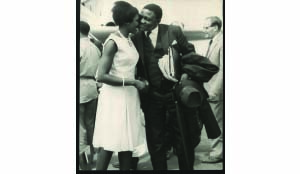

Whenever it was time to deliver his National Budget Speech in Parliament, the flamboyant and pipe-smoking Arthur Wina was often photographed carrying the copper-coated Briefcase with his young and glamorous wife Inonge next to him. It was a scene on the steps of the National Assembly in Lusaka former Times of Zambia chief photographer David Tonga never failed to capture.

Once inside the august House the couple were greeted with a standing ovation by parliamentarians, members of the diplomatic corps, and cooperating partners eager to know the content of his Budget Speech.

Zambia is known worldwide as one of the key members of Copper Producing and Exporting Countries (CPEC). So nearly 90 percent of the revenue the Zambian Government needed and still needs for its development programmes naturally came and still comes from copper exports, mineral taxes and loyalties that have always been a constant source of conflict between the state on one hand and investors on the other.

In other words the present wrangles surrounding the new tax measures for the mining industry introduced by current Minister of Finance Alexander Chikwanda in his 2015-2016 Budget are not entirely new or strange phenomenon.

Nationalist leaders who fought for the country’s emancipation from the vestiges of colonialism had to grapple with tax and other issues that threatened to economic future of the new sovereign state.

Following the dissolution of the Federation of Rhodesia and Nyasaland in 1963, it was revealed that the former British South Africa (BSA) Company had no legitimate right to mineral loyalties from which it had been exacting more than a pound of flesh because the Cecil John Rhodes’ company agents had ln the early 1890s cheated African chiefs as to the extent of their chiefdoms.

This came to light after the leaders commissioned some high-powered historical research in the archives in Lusaka which cast doubt on the company’s claim to legitimate possession of the mineral rights at all. Wina and his team of negotiators argued in their concerted effort to end the blatant exploitation that what is now the Copperbelt had ‘fallen outside the territory of the chiefs from whom the company – not the British government in London – had acquired its concessions.

According to journalist/historian Anthony Martin, these contentions together with telling evidence that the colonial government had itself been aware of the shakiness of the BSA company’s claim at the time of the previous dispute at the end of the 1940s, were published in a forcefully argued White Paper on 21 September, barely a month before the date set for independence.

To settle the issue once and for all, the new African leaders wanted the British government, in its capacity as the ‘protecting’ power, to pay an equal amount to the BSA as compensation. This was to assure investors generally of Zambia’s good faith while at the same time repudiating any actual obligation to the BSA Company.

A final meeting was held towards the end September between the British government, the colonial power which was represented by Chancellor of the Exchequer Lord Dilhorne, and the Northern Rhodesian government team represented by Arthur Wina, the Zambian finance minister. The Zambians insisted they were prepared to offer 2 million pounds – BSA indicated to Whitehall that they would take 18 million pounds. But Sir Alec Douglas-Home’s Conservative government, which was facing an election at home, would not accept responsibility, arguing it had no intention of contributing the 16 million pounds needed to bridge the gap.

The talks ended in deadlock but Wina and his team had staged a coup that was to have far-reaching ramifications. The only card the company had left was its offer to submit the issue to the Judicial Committee of the Privy Council. The Zambians made it clear they were not prepared to consider this step and would even hold a referendum to expropriate the BSA Company immediately after October 24 – and 2 million pounds was absolutely their final offer.

With the arrival of a Labour Party Prime Minister (Harold Wilson) at No 10 Downing Street, prospects of Britain’s coming to the rescue grew by leaps and bounds. Zambia sent a new team to London to launch a fresh appeal to make the independence party a success. Gladly their plea found its way into the Cabinet room for the last British Cabinet meeting before Zambian independence.

It was another coup by Zambia’s first finance minister and his Cabinet colleagues in the sense that the new British Commonwealth Secretary, Arthur Bottomley, outgoing Northern Rhodesia governor, Sir Evelyn Hone, the elderly BSA Company president Paul Emrys-Evans, and Anglo American chairman, Harry Oppenheimer, who was also a director of the BSAC of which Anglo was the biggest single shareholder, met at Government House (now State House) to resolve the crisis on Northern Rhodesia’s last day.

Presented with the final ‘take-it-or-leave-it’ offer of 2 million pounds from Zambia plus another 2 million pounds from Britain, BSA’s Emerys-Evans was reduced to the ‘humiliating position’ of having to beg for a guarantee that the whole amount would be ‘free of tax’. But none was forthcoming. Left to himself, Emerys-Evans gave in and accepted the terms.

The breakthrough was announced to journalists at the Independence Stadium that night a few minutes before the Union Jack was lowered for the last time and the new Zambian flag was raised for the first time. Soon afterwards the exploitative BSAC itself passed into history, being swallowed up in a merger with two other companies, Consolidated Mines Selection and Central Mining – to form the new Charter Consolidated group.

Zambia thus began life with a spectacular business coup, acquiring a claim on the mining industry which netted the new Republic many millions in government revenue over the next five years (1964-69). With the BSA loyalties reverted to the Zambian Government, the mining companies were effectively paying tax in two separate forms: the flat-rate loyalty, and company tax.

In federal days the latter was at the rate of 40 percent of profits or 8 (eight) shillings in the pound of which 83.3 percent went to the federal and 16.7 percent to the territorial government under an arrangement where there was a 20 percent surcharge on the federal company tax.

To rationalise the process and reassure the investors that the new government meant well, Wina introduced in his 1964 budget a provision, which ushered in a new consolidated rate of company tax, abolishing the territorial surcharge that no longer had any function. The tax reliability of companies earning a pre-tax profit of less than 500,000 pounds, in other words all except the mining companies, was thus reduced from 8 shillings to 7 shillings in a pound. But a special rate of 9.6 shillings in the pound was brought in for companies earning more than this, which meant the copper mines – the goose that lay the golden egg.

According to Martin, the essential point that the Zambian government needed to accept in principle at the time was that it was worthwhile making concessions in the system of taxation to encourage new development and higher production, if the alternative was not to get extra production and thus forgo tax in the long run as well as foreign exchange, employment and the generation of additional local income.

Suffice it to say thereafter a series of tax reforms were introduced all meant to encourage rather than discourage the investor; as the present Government is doing – and a mutually acceptable solution to the current situation will certainly be found sooner than later.

I remember the fact that in Gaborone the government at some stage enlisted the help of the European Union (EU) whose Delegation seconded a team of tax expert to the Botswana Unified Revenue Service (BURS) – and the arrangement seems to have worked well for them.

Revenues derived from diamond sales by Debswana Diamond Company, which is jointly owned on a 50-50 basis by the Botswana Government and De Beers (owned by the Oppenheimer family) have over the years helped transform the Southern African Development Community (SADC) nation into a middle-income country.

The Zambian Government similarly wants to do the same especially if copper prices on the world markets continue to be buoyant and investors continue to cooperate in term of taxes and increased production (which is what pioneering sons like the late Arthur Wina strived to achieve) so that at the end of the day, neither party feels short-changed.

Extra reporting: Anthony Martin (Minding Their Own Business, Zambia’s struggle against Western control).

Comments: Please send your emails to: alfredmulenga777@gmail.com